mississippi income tax rate 2021

The House Ways and Means Committee on Monday passed a bill that would eliminate Mississippis personal income tax within a decade and reduce the states highest-in-the-nation tax on groceries while raising the sales tax and other taxes. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Tax Rates Exemptions Deductions Dor

2022 Mississippi state sales tax.

. The graduated income tax rate is. 3 on the next 3000 of taxable income. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Our calculator has been specially developed. Mississippi Tax Rate Information. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Under House Bill 1439 the sales tax on groceries would be reduced to 45 percent on July 1 2021 to 4 percent on July 1 2024 and to half its current rate 35 percent starting on July 1 2026. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. Tax rate used in calculating Mississippi state tax for year 2021.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The landmark House Bill 1439 was authored by the three highest-ranking House Republicans. 5 on all taxable income over 10000.

Currently groceries are included in Mississippis sales tax base and taxed at the general sales tax rate of 7 percent. Examples are 120 for 6000 190 for 9500 240 for 12000 If no exemptions are claimed enter 000. Because the income threshold for the top bracket is quite low.

All these rates apply to incomes over 2 million with the highest rate of 1090 applying to incomes over 25 million. Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period. Looking at the tax rate and tax brackets shown in the tables above for Mississippi we can see that Mississippi collects individual income taxes similarly for Single and Married filing statuses for example.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Counties and cities can charge an additional local sales tax of up to 025 for a maximum possible combined sales tax of 725. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Ad Compare Your 2022 Tax Bracket vs.

Mississippi Salary Tax Calculator for the Tax Year 202122. Exact tax amount may vary for different items. Discover Helpful Information and Resources on Taxes From AARP.

Mississippi has a graduated tax rate. 4 on the next 5000 of taxable income. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

These back taxes forms can not longer be e-Filed. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi residents have to pay a sales tax on goods and services.

Your 2021 Tax Bracket to See Whats Been Adjusted. Your average tax rate is. Detailed Mississippi state income tax rates and brackets are available on this page.

Below are forms for prior Tax Years starting with 2020. Multiply the result by 2. Tax Rates Exemptions Deductions.

6 In New Jersey A10 was enacted in September 2020 expanding the states so-called millionaires tax. Mississippi Tax Brackets 2020 - 2021. Tax Year 2018 First 1000 0 and the next 4000 3 Tax Year 2019 First 2000 0 and the next 3000 3 Tax Year 2020 First 3000 0 and the next 2000 3 Tax Year 2021.

0 on the first 2000 of taxable income. Income tax is a tax that is imposed on people and businesses based on. These rates are the same for individuals and businesses.

Mississippi Income Tax Forms. The tax rate reduction is as follows. If youre married filing taxes jointly theres a tax rate of 3 from 4000 to 5000.

The previous 882 rate was increased to three graduated rates of 965 103 and 109. Speaker of the. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Mississippi State Personal Income Tax Rates and Thresholds in. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

Taxable and Deductible Items. For tax year 2021 Michigans personal exemption has increased to 4900 up from 4750 in 2020. Mississippi sales tax rates.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122. Divide the dollar amount in Item 6 of the state certificate by 100. This law raised income taxes by reducing the kick-in for the states top marginal individual income tax rate.

The Mississippi state sales tax rate is 7 and the average MS sales tax after local surtaxes is 707. We can also see the progressive nature of Mississippi state income tax rates from the lowest MS tax rate bracket. There is no tax schedule for Mississippi income taxes.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Mississippi Income Tax Calculator 2021.

Historical Mississippi Tax Policy Information Ballotpedia

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi Tax Rate H R Block

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Calculator Smartasset

How To Start A Business In Mississippi Chamber Of Commerce In 2021 Starting A Business Small Business Development Business

Mississippi Sales Tax Small Business Guide Truic

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mississippi Tax Rate H R Block

Mississippi Tax Forms And Instructions For 2021 Form 80 105

The 10 Happiest States In America States In America Wyoming America

Infographic The Worst Roads In The Usa Infographic Social Science Civil Engineering

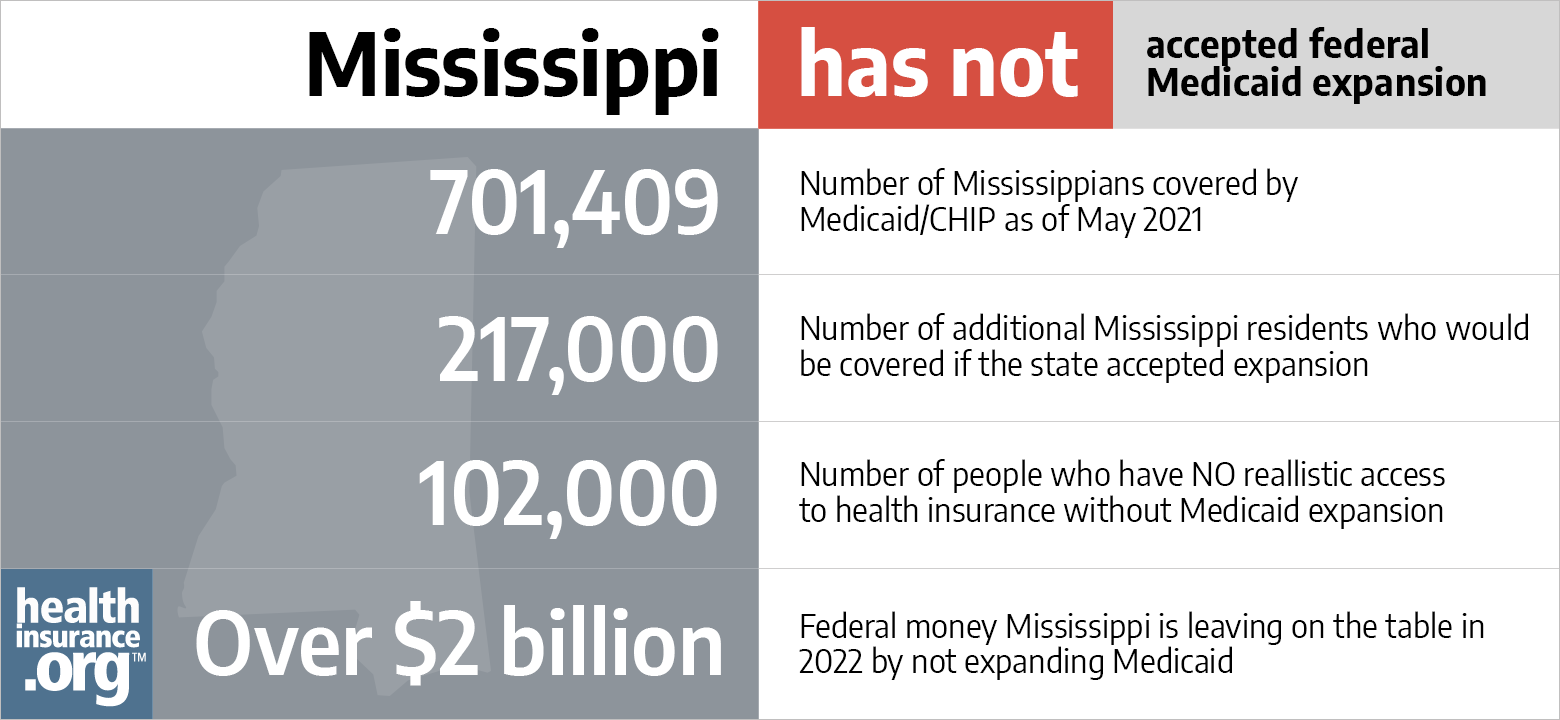

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org